44 present value formula coupon bond

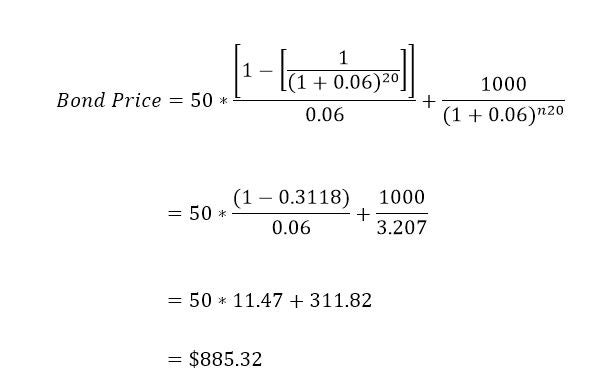

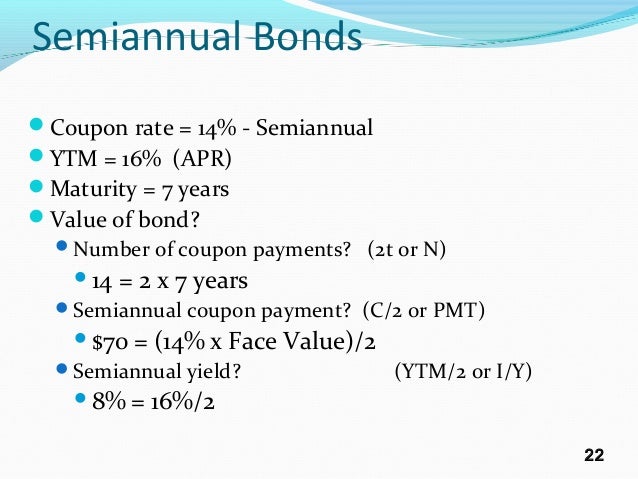

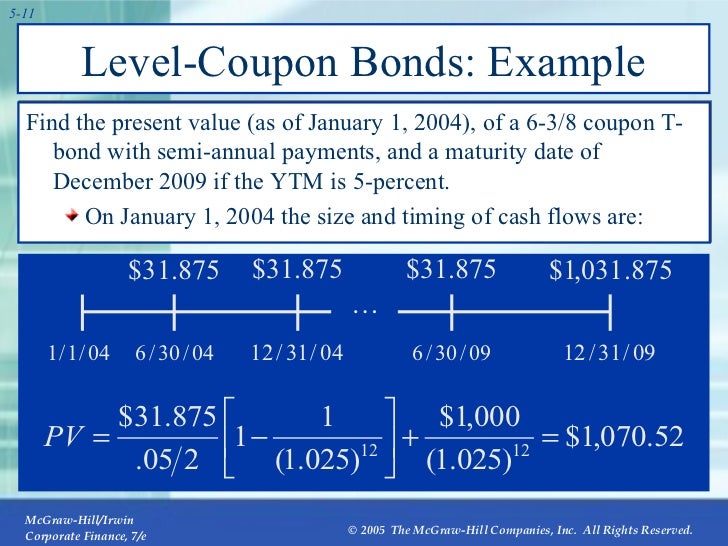

Bond Price | Definition, Formula and Example - XPLAIND.com Since the interest is paid semiannually the bond coupon rate per period is 4.5% (= 9% ÷ 2), the market interest rate is 4% (= 8% ÷ 2) and number of coupon payments (time periods) are 20 (= 2 × 10). Hence, the price of the bond is calculated as the present value of all future cash flows as shown below: How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Coupon Bond Present Value Formula Coupon bond present value formula Be the first to know about the latest Sports Direct UK sales and discount codes when you enter your email address in the newsletter subscription box.

Present value formula coupon bond

How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond › calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates

Present value formula coupon bond. Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A ... Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0%) ^ 20. PV = $554. The price of this zero-coupon is $554, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

› terms › pPresent Value (PV) Definition - Investopedia Feb 01, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... › net-present-value-formulaNet Present Value Formula | Examples With Excel Template NPV = Net Present Value Formula – Example #2. General Electric has the opportunity to invest in 2 projects. Project A requires an investment of $1 mn which will give a return of $300000 each year for 5 years. Bond Formula | How to Calculate a Bond | Examples with Excel ... - EDUCBA PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k PV of Face Value = F / (1 + r / n) n*t Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below. Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] Bond Valuation Overview (With Formulas and Examples) The formula adds the present value of the expected cash flows to the bond's face value's present value. Below is the following formula for our valuation. ... Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42. A natural question one would ask is, what does ...

How to Figure Out the Present Value of a Bond - dummies Here are the steps to compute the present value of the bond: Compute annual interest expense. The interest expense is $100,000 x 0.07 = $7,000 interest expense per year. Find the market interest rate for similar bonds. You can check a financial publication, such as The Wall Street Journal, for current market rates on bonds. Valuing Bonds | Boundless Finance | | Course Hero F = face value, i F = contractual interest rate, C = F * i F = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed / appropriate yield to maturity, M = value at maturity, usually equals face value, and P = market price of bond. › present-value-factor-formulaPresent Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash flow. Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. Five inputs are needed to use the "Rate" function; time left ...

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Coupon Payment | Definition, Formula, Calculator & Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2].

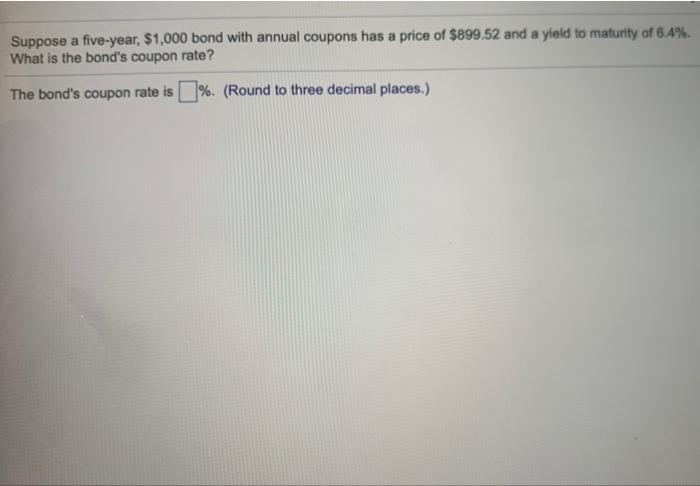

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Bond Formulas - thismatter.com The most common bond formulas, including time value of money and annuities, bond yields, yield to maturity, and duration and convexity. ... Bond Value = Present Value of Coupon Payments + Present Value of Par Value. Duration Approximation Formula; Duration = P-- P + 2 × P 0 (Δy) P 0 = Bond price.

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Bond Valuation | Meaning, Methods, Present Value, Example | eFM Present Value n = Expected cash flow in the period n/ (1+i) n Here, i = rate of return/discount rate on bond n = expected time to receive the cash flow This formula will get the present value of each individual cash flow t years from now. The next step is to add all individual cash flows.

Calculating the Present Value of a 9% Bond in an 8% Market Let's use the following formula to compute the present value of the maturity amount only of the bond described above. The maturity amount, which occurs at the end of the 10th six-month period, is represented by "FV" .The present value of $67,600 tells us that an investor requiring an 8% per year return compounded semiannually would be willing to invest $67,600 in return for a single receipt of ...

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

exceljet.net › formula › present-value-of-annuityExcel formula: Present value of annuity | Exceljet In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments,...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates

Post a Comment for "44 present value formula coupon bond"