45 what are coupon payments

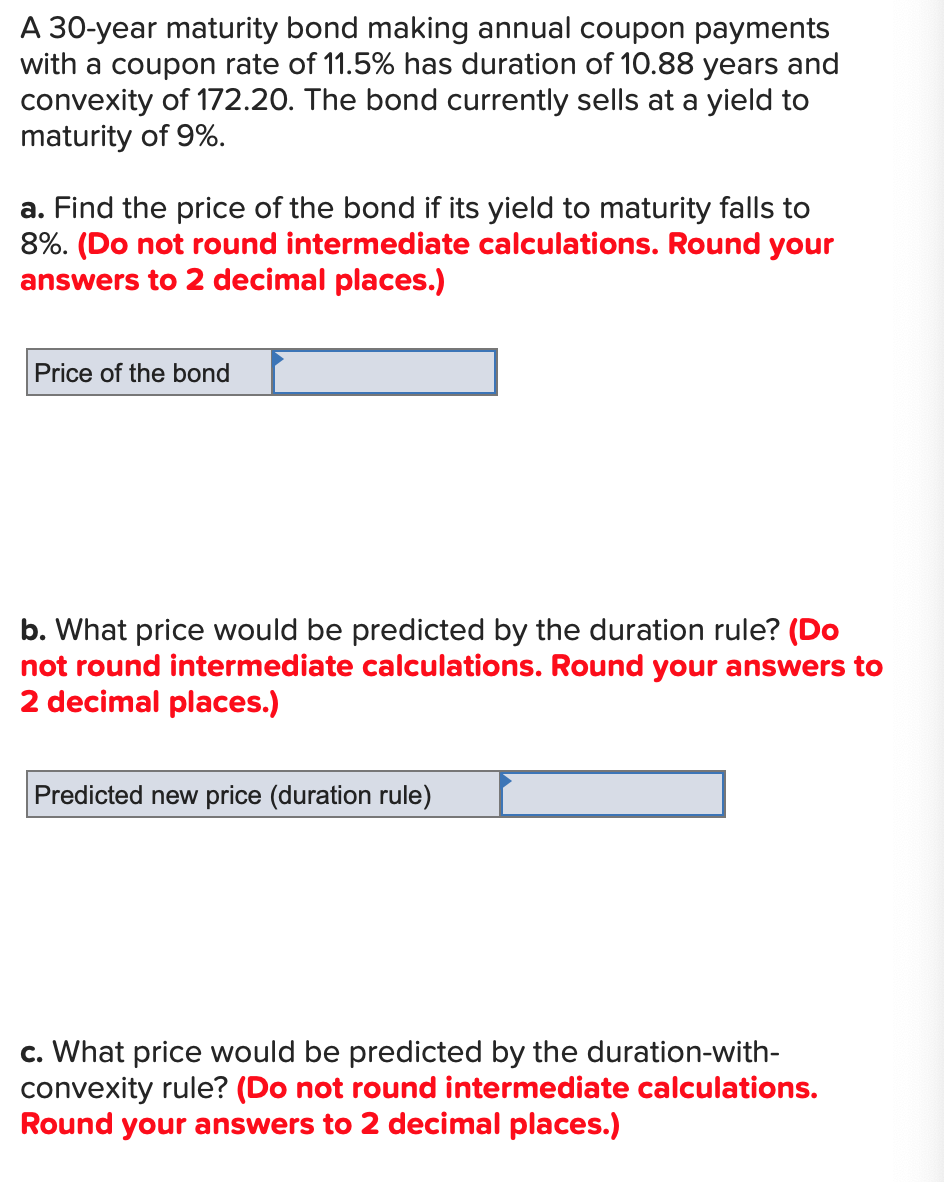

What does payment coupon mean? - Trentonsocial.com Definition of coupon. 1 : a statement of due interest to be cut from a bearer bond when payable and presented for payment also : the interest rate of a coupon. 2 : a small piece of paper that allows one to get a service or product for free or at a lower price: such as. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... You may receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase or sale. Coupon payments on the ETNs will vary and could be...

What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

What are coupon payments

Coupon Bond: Definition, How They Work, Example, and Use Today WebMar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... UBS declares quarterly coupon payments on Exchange Traded Note: AMUB New York, November 21, 2022 - UBS Investment Bank today announced coupon payments for the ETRACS Alerian MLP Index ETN Series B (NYSE Arca: "AMUB"), traded on the NYSE Arca. * The table above provides a hyperlink to the relevant prospectus and supplements thereto. For more information on each ETRACS ETN, see "List of ETNs". Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no...

What are coupon payments. Coupon Rate Definition - Investopedia WebMay 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... digital opportunities with the world’s most trusted ... Make smarter business decisions knowing how consumers and businesses manage their money, borrow and make payments. Health → Explore our healthcare research which analyzes the aspects being transformed by tech and creating opportunities for providers and payers. › terms › cWhat Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to... UBS declares coupon payments on 5 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon linked to 1.5 times the cash distributions, if any, on the respective underlying index constituents, less withholding taxes, if any.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia WebSep 09, 2022 · Fixed-rate corporate or government bonds pay regular interest payments to bondholders. These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 ... Novolipetsk Steel: Update regarding the coupon payment for the ... 28 November 2022. Update regarding the coupon payment for the Eurobonds due 2024. Novolipetsk Steel ("NLMK") hereby informs the holders of the 4.00 per cent. loan participation notes due 2024 ... Payments | Internal Revenue Service - IRS tax forms WebOct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

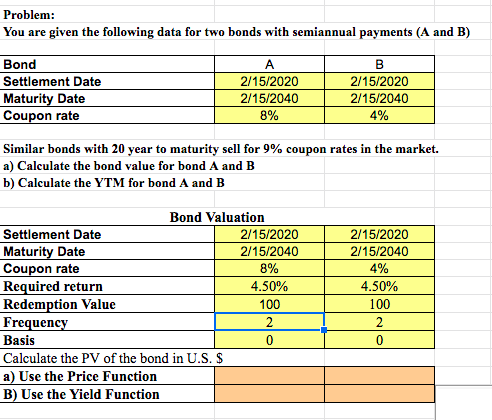

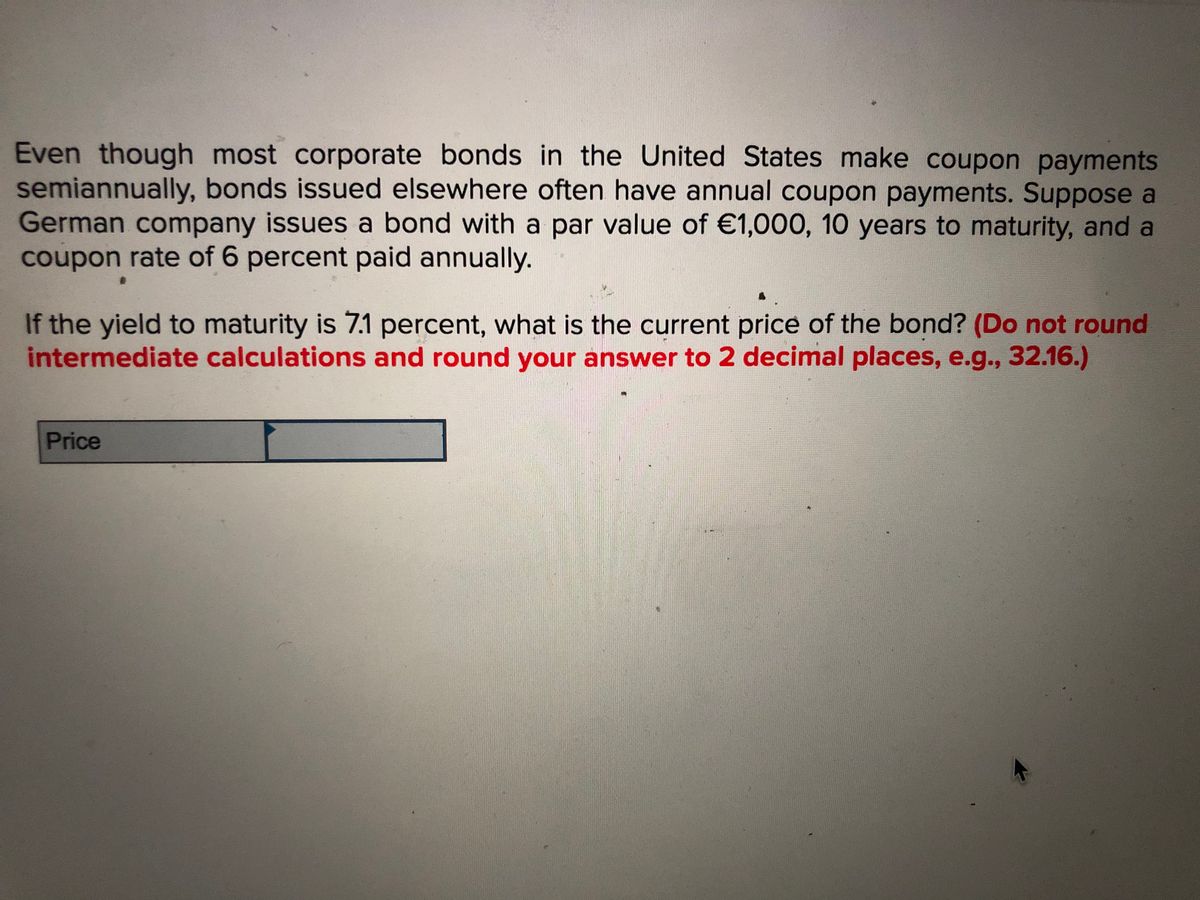

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Coupon Bond - Guide, Examples, How Coupon Bonds Work Updated October 13, 2022 What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market …

What Is a Bond Coupon, and How Is It Calculated? - Investopedia WebApr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Unlock digital opportunities with the world’s most trusted … WebMake smarter business decisions knowing how consumers and businesses manage their money, borrow and make payments. Health → Explore our healthcare research which analyzes the aspects being transformed by tech and creating opportunities for …

› payPayments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Coupon Payments Definition | Law Insider Coupon Payments means coupon payments, the details of which will be specified in the applicable Pricing Supplement. Coupon Payments. - means the payments representing distributions of profits (or return of capital) in relation to the Trustee LP that the ABC Arrangement provides for the Scheme trustee to receive.

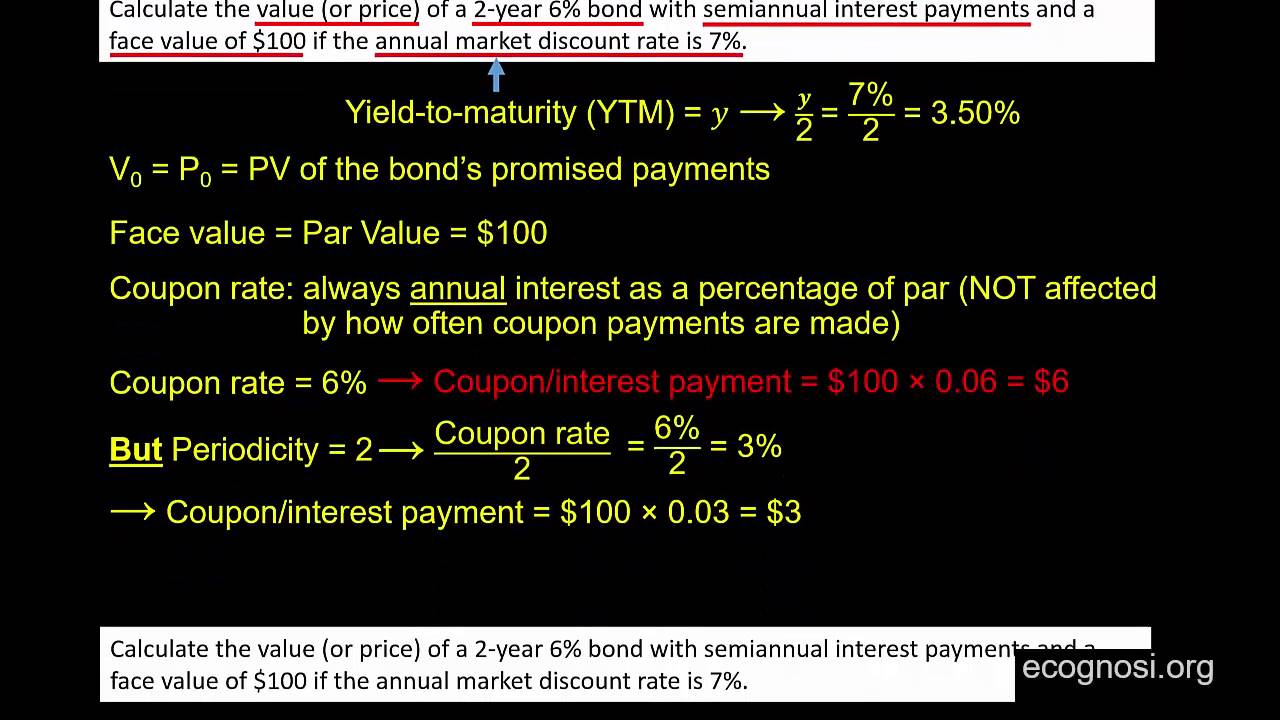

Coupon payments financial definition of Coupon payments Coupon payments are expressed as a percentage of the face value ( par) of a bond. For example, if one holds a bond worth $100,000 at 5% interest, the bondholder will receive $5,000 in coupon payments per year (or, more strictly, $2,500 every six months) until the bond matures or he/she sells the bond.

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol WebOct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

UBS Declares Coupon Payments on 12 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon, and MLPR and BDCX pay a variable quarterly coupon, each linked to 1.5 times the cash distributions, if any, on the respective underlying index ...

What is Coupon payment | Capital.com Content It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value .

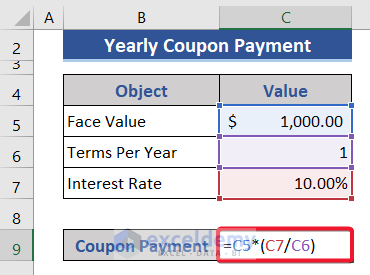

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2

Coupon Payment Calculator - Definition | Steps by solution 🥇 The coupon payment is a feature of fixed income securities. It's the regular interest payment at specified intervals for a specified period. The coupon rate is the annualized percentage of the face value, or par (100%), paid as interest on a bond's par value. Coupon payments are typically made semi-annually and mostly you receive them every ...

Coupon (finance) - Wikipedia WebIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and …

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period...

Novolipetsk Steel: Update regarding the coupon payment for the ... Update regarding the coupon payment for the Eurobonds due 2024. Novolipetsk Steel ("NLMK") hereby informs the holders of the 4.00 per cent. loan participation notes due 2024 (ISIN ...

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

› news › homeUBS Declares Coupon Payments on 12 ETRACS Exchange Traded ... Oct 06, 2022 · UBS Investment Bank today announced coupon payments for 12 ETRACS Exchange Traded Notes (the “ETNs”), all traded on the NYSE Arca. NYSE Ticker ETN Nam

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual ...

UBS Declares Coupon Payments on 12 ETRACS Exchange Traded … WebOct 06, 2022 · UBS Investment Bank today announced coupon payments for 12 ETRACS Exchange Traded Notes (the “ETNs”), all traded on the NYSE Arca. NYSE Ticker ETN Nam

Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no...

UBS declares quarterly coupon payments on Exchange Traded Note: AMUB New York, November 21, 2022 - UBS Investment Bank today announced coupon payments for the ETRACS Alerian MLP Index ETN Series B (NYSE Arca: "AMUB"), traded on the NYSE Arca. * The table above provides a hyperlink to the relevant prospectus and supplements thereto. For more information on each ETRACS ETN, see "List of ETNs".

Coupon Bond: Definition, How They Work, Example, and Use Today WebMar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

Post a Comment for "45 what are coupon payments"